Base Algorithm Technology Architecture - BATA

Most trading platforms are based on technical analysis and charting. The Wall Street Warrior was created to answer questions other platforms

could not efficiently answer on an intra-day basis:

1. WHAT WORKS?

2. WHAT DOESN'T WORK?

Base Algorithm Technology Architecture

The Base Algorithm Technology Architecture (BATA) was created to make it simple for anyone to create, back-test, and analyze trading systems in 'RAPID TIME'. This is much different than most trading platforms as most require the trader to learn a programming language and code their own strategies. The BATA includes many different algorithms and are based on statistical price patterns, not technical indicators. The algorithms are completely separate from each other as the BATA allows you to create trading systems from scratch. After you back-test your trading system, you can use the Wall Street Warrior's web-based reporting to view, analyze, and compare trading systems side-by-side. Increase your trading system's probability and profitability by using the Wall Street Warrior's web-based data-mining application to help you find patterns that have a high probability of success for trading your systems.

Time Controls

The Time Contols tell the Wall Street Warrior when to begin using the algorithms, when to stop entering a position, and when to exit any remaining positions.

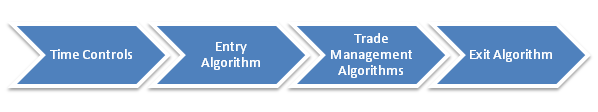

The BATA techniques are divided into the 4 different components of a trade which are controlled by the Time Controls which tell the Wall

Street Warrior when to allow the algorithms to trade. The Profit Target and Stop Loss algorithms are Trade Management Algorithms.

- Entry and Re-Entry

- Profit Target

- Stop Loss

- Exit

Entry

The trade entry algorithms allow you to select from a group of price based entry techniques. The techniques are extremely adjustable and allow you to set your own criteria for entering a trade. We constantly add new algorithms based on our findings from our statistical analysis of price movements on an intra-day basis.

A variety of entry techniques include many varieties of the following price based methods:

- Breakouts

- Opening Range Breakouts

- Pullbacks

- Reversals

- Non-directional Entry Methods

- Other Proprietary Entry Methods

Trade Re-Entry

The question that you have to ask when trading, is: Do I re-enter after I have been stopped out? If you do re-enter, where do you re-enter the trade?

Profit Targets

Is it more profitable to trade with a Profit Target?

Stop Loss

Do Stop-Loss orders help or hurt your trading system?

We developed the Wall Street Warrior to find out if price patterns and specific entry methods would work on an intra-day basis. The initial goal was to apply specific trading techniques after the presence of specific price patterns appeared on the daily charts. While we still utilize this technique, we were surprised that many of the techniques we included in the Wall Street Warrior were successful even without filtering for the price patterns.

Does this approach

REALLY WORK?

Reports

All reports include back tested results. Available Soon - Dynamic Reports that generate real-time data for analysis.

9:30 am ET

OPEN

What does itreally tell YOU?

Bull & Bear Traps

Bull & Bear Traps

A detailed analysis of Bull and Bear Traps and their effect on the SPY, DIA, and the QQQQ.

Proprietary Volatility Based Momentum Levels

What do they say

about the Stocks

YOU are trading?

Day Trading ETFs

Market vs. Sector Based ETFs

A detailed analysis of intraday trading activity.

Breakout vs. Pullbacks for ETF Trading

A detailed analysis of 10 ETFs with breakout vs. bullback entry methods.

Trailing Stop or Not

An intraday analysis of implementing a trailing stop when day trading ETFs.

ETF Gap Trading

Trading gaps on ETFs.

High Probability Patterns

A detailed analysis of 10 daily chart patterns on 10 ETFs.

Online Trading

Business Plan

Template

Start out Trading on the 'Right Foot'! Begin by using the Wall Street Warrior's online template to create a Trading Business Plan.

Day Trading Reports

Entry: Breakout or Pullback

What is the best entry method? A detailed analysis of 25 stocks over a 7 year period.

High Probability Patterns

A detailed analysis of 10 daily chart patterns on 25 stocks.

Gap Trading

A detailed analysis of trading gaps on 25 stocks.